Is It Possible to Make a Living Trading Stocks?

Is It Possible to Make a Living Trading Stocks?

Types of Successful Traders

Take the difference between your entry and stop-loss prices. For example, if your entry point is £12 and your stop-loss is £11.80, then your risk is £0.20 per share.

When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. Automatic execution helps traders implement strategies for entering and exiting trades based on automated algorithms with no need for manual order placement. Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Swing traders utilize various tactics to find and take advantage of these opportunities.

As we know, forex brokers and CFDs offersignificant leverage in their trading accounts. In principle, this exists to give traders the opportunity to earn money in CFDs and forex with small investments.

This type of order allows you to define the closing price of your trade. Your trade will close once it reaches that level, even when you are not present. In other words, setting a stop loss will give you the peace of mind of not losing more than the limit you defined. Finally, if you want to succeed in trading, don't forget to do extensive tests bybacktesting your favorite markets until you feel secure in your strategy. Problems arise when new traders become obsessed with chasing profits, and this anxiety can lead to mistakes that cause losses.

Graphical trading charts can be based on many different time frames or even on non-time-related parameters such as number of trades or price range. With an essentially infinite number of choices, choosing the best time frame or other variable for a particular trading style and type of asset can seem like a daunting task. But if you are trading smartly, it actually becomes a very simple task.

Individual stocks give you a chance to outperform the broader market averages over the long run. Even a single share can grow over the years to become worth a huge amount and help you reach your financial goals.

This means that even if the trader only wins 50% of her trades, she will be profitable. Therefore, making more on winning trades is also a strategic component for which many forex day traders strive.

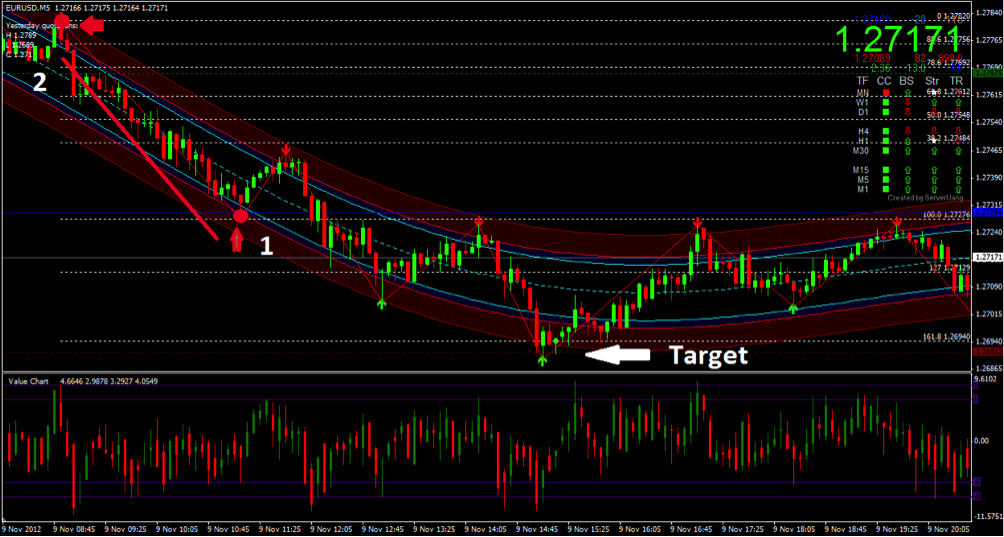

Finally the price converged filling my order, but unfortunately I bought high, Then, It was not a perfect entry. So, the trade followed my Trading Plan and the strong momentum pushed the price up to my target.

Investing only $20 won't make you rich, but it can help you get your foot in the door and make you feel comfortable. As your circumstance change, increase the amount of your regular transfers. Diversify your portfolio and continue to be patient and consistent.

They'll pay dividends that will allow you to invest more and more. Eventually you'll have enough money to buy into some of the funds that require higher initial investments ($100, $250, etc.). More than anything, you have money in the market that is earning you more than the measly .01% APY it would get in your savings account.

- This sort of market environment offers healthy price swings that are constrained within a range.

- Now the reality is that if you have NO time and a don’t care about how high risk it is, you just want a chance at doubling it… go and put it on the Roulette table.

- Originally launched in 2002, the scanning platform has evolved and re-invented itself through the years at a tepid pace to become one of, if not, the best stock market scanner publicly available.

- Therefore, experimentation may be required to discover the Forex trading strategies that work.

Similar to other social media apps Snapchat can make you a lot of money if you have the right following for it. For example, 78% of 18- to 24-year-olds are active on Snapchat.

You can calculate the average recent price swings to create a target. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Once you’ve reached that goal you can exit the trade and enjoy the profit.

It's understandable if your first thought was to start by taking your $100 and buying small amounts of stock. After all, there's a lot of compelling evidence that investing in stocks is the best way for regular people to attain financial independence. But a lot of people don't understand how important it is to also have a strong margin of safety with their finances. For most of us, the best way to get that margin of safety is by having cold, hard cash. Having a solid system and control of one’s emotions is critical to success.

It gives money to pay bills, to put food on the table and to pay the school of children. In the same way, all the extra money is a blessing so as a Paycheck for the hard work. The price reached my lowest order, but I missed to set the order to the highest entry. As a result, that Sell trade paid me +9177 pips of Realized Profit.

Some apps, such as Acorns, use a clever, passive investing model. Every time you make a purchase from a linked money source, Acorns will deposit a small amount into your investing account.

Ideally, this methodology should be tested over months or years, in all different market environments, first with a demo account and then with real money. The Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and the Internal Revenue Service (IRS) all offer valuable information for day traders. Introductory books on strategies and theories will help you get acquainted with the playing field.

This strategy typically uses tick charts, such as the ones that can be found in MetaTrader 4 Supreme Edition. This trading platform also offers some of the best forex indicators for scalping. In addition, the Forex-1 minute Trading Strategy can be considered an example of this trading style. Did you know that Admiral Markets offers an enhanced version of Metatrader that boosts trading capabilities?

You may have heard that maintaining your discipline is a key aspect of trading. While this is true, how can you ensure you enforce that discipline when you are in a trade? One way to help is to have a trading strategy that you can stick to.

Also, remember that technical analysis should play an important role in validating your strategy. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Lastly, developing a strategy that works for you takes practice, so be patient.

Instead, it is extremely relevant that the algorithm, so as any trader, is right for the 20-30% of the times and for these successful entries it generates a consistent reward. It is not really relevant if you get a number of profitable trades that is higher than the wrong trades. Every stop loss you take costs to you 4 successful trades that have already realized the profit. Another relevant thing, very important thing, is that you get the 90% of success on trades that pay nothing, only the 1% of profit. But in any case, they need to be reviewed to get a better result.

Комментарии

Отправить комментарий